YIKES! It’s Budget Time!

You are all doing incredible work, finding ways to continue to provide vital services AND maintain viability even when confronting the reality that the current fiscal year’s budget is gaining greater irrelevance under the extraordinarily ‘abnormal’ operating conditions of the COVID-19 response. The current reality of what predictable expenses and revenue are, is not only different, but wholly unimagined.

So then, what does a healthy & realistic budget process look like given that many of you are approaching the close of your fiscal year and the demands of drafting and approving next year’s budget in a time of so much ‘unknown.’

I want to start with an observation …

Your organization is not the organization’s budget. The organization is the day-to-day operations that put assets to work creating benefit in the world, not the prediction that was made several months ago about the sources and allocation of money for a given 12 month period (aka your budget) – nor are you the predictions you make about what the next 12-18 months might look like. The budget is just a tool we use.

In fact, the budget process – which includes developing the financial model that represents how the organization will operate over a set 12-month period AND the monitoring of the actual operations against that model over those 12-month – is really a confidence game. Not the bad kind that they make movies about where a person builds up false confidence in a lie only to cheat someone out of their life savings, but rather the real process of creating authentic confidence in the organization and, more importantly, those who lead it.

What we are really doing when we draft a budget is building up confidence, and comfort, about a set of assumptions, forecasts, and guesses we employ to predict the future. It is not that we have confidence in the actual numbers that show up in a budget spreadsheet, it is that we have confidence in the thinking (meaning assumptions) that produced those predictions. So much confidence, in fact, that we are willing to bind ourselves to those predictions as the basis for financial accountability for the duration of the fiscal year.

This process helps bolster our sense of stability – a feeling most people crave – by illuminating what we can expect well out into the future.

In the past – you know, back in February 2020 – this made sense. We generally had a strong experiential base to step into that prediction process. The broader predictability of the external environment validated many of our assumptions AND reinforced our forecasting prowess.

Still, there was always a healthy dose of ‘unknowns’ and ‘what ifs’ built into this process, and for better or worse, we often took our assumptions for granted and even left them un-articulated because we ‘assumed’ they were so obvious or normal.

In this old budget process, we rarely had to totally revisit our assumptions or dramatically alter our predictions. Instead, we knew we would have to monitor and perhaps adjust as the fiscal year progressed, tinkering with an eye to getting as close to the original prediction as possible by the end of the year. We critiqued a deficit and/or celebrated a surplus – but rarely examined in depth the underlying assumptions we used to make the original predictions.

We had confidence in our assumptions and how they held true over time and, therefore, would shift our focus forward onto predicting the next year and building the next budget.

An acceptable model, but still with cracks given the reliance on often un-articulated, and sometimes, unchecked assumptions.

Today, that model is no longer just cracked, it is laying on the floor in pieces. A system built on predicting and codifying 12 to 18 months out does not work well when nearly everything is unknown – there is little predictability or stability to be had.

To be clear, our current situation is not anything most of us ever imagined. And as each day passes, what we envision ‘normal’ being in the future gets a bit fuzzier.

There are no ‘past experiences’ or ‘best practices’ or ‘examples’ of what to do. Our assumptions of how things work or will work have had the rug pulled out from under them. We have no experiential knowledge to assess whether our past and current assumptions will hold as valid or invalid in the short or long term.

The confidence in our assumptions that our old budgeting process demanded is missing … therefore, the confidence in the predictions is missing … therefore, being comfortable with holding ourselves accountable to those predictions is unreasonable – YIKES WHERE DOES THAT LEAVE US!

What does it look like to build a healthy, realistic budget process today, that will build the confidence we need and not bury us financially or emotionally in the future?

First, accept that your fiduciary responsibility is not to ‘make budget’ – it is to ensure that assets are being used to effectively and efficiently advance outcomes in the community, in alignment with your values, in a way that is financially viable for as long as it can be.

Next, acknowledge that the success of our past budgeting practices and assumptions was built on confidences we don’t currently have. We used to…

- have clarity about what we did programmatically; what it took to do that work; and could accurately project expenses to support it

- be able to reasonably predict a year’s worth of revenue from fees, grants, donations, and/or contracts based on our program model and past financial performance

- had a sense of how the social, political, and economic systems would play in our favor or against us

With much of this missing, we need to re-envision, and re-align, the budget process based on building a new set of confidences that relies on articulating and validating assumptions. We cannot expect the past budgeting practices to build the comfort, confidence, and competence we need now.

Steps to building confidence in the next budget

Start where you have strong competency – Programs and Operations

Engage in scenario planning – You are good at determining what it takes to deliver your services.

While the external world is in constant flux with unpredictable health guidelines and economic situations now and into the near future, you still know your outcomes for people and what you value as important. You are finding new ways to advance those outcomes as best you can and are determining what those new models look like in terms of what it takes to make them work (resources, assets, infrastructure, etc).

You are mapping out new programming and operating models – whether you thought you were or not.

-

- Continue this work assuming that there will be intermediary iterations of program delivery models that can be put in place as public health guidelines change. For each program delivery model, consider building a 1-month operating budget for the organization. This gives you a ‘modular’ type budget that you could contract or expand based on how long you think you may be delivering a specific programming model.

- Determine several options for what the next fiscal year could look like in terms of changes in program delivery and operational support. This involves both guessing at how long you might operate under each program delivery model over the fiscal year AND noting the conditions that need to be in place to change from one model to another. For example, 1st 3 months in ‘lock-down’ model, next 3 months in ‘social-distance’ model, next 4 months in ‘small-gatherings only’ model…

(this is an important piece of thinking to have articulated when it comes to monitoring finances moving forward) - Determine the financial requirements that each projected scenario requires. This ensures that the assumptions about what you can do programmatically are clearly grounded in both the external conditions that exist and the financial needs each scenario would require.

Move to the more challenging – Revenue & Capital

Admittedly, this is where the most ‘unknowns’ exist. So, start with what you can build confidence around.

-

- What existing commitments can you reasonably rely on. What grants, contracts, and/or pledges can you expect to see during the next fiscal year (some funders are already extending grant renewals at 2019/2020 levels)?

- If you have reserves or other restricted capital, this may be the time to put them to use as ‘revenue’ by releasing them from restriction and designating them as general operating cash for the fiscal year. (Yes, it will reduce your net assets, but it will give you needed operating funds)

- Avoid building false confidence around past revenue models. Clearly identify revenue targets that correspond with the programming and operating model scenarios you created (see above). Identify the gap that would exist. Clearly articulate the strategy you plan to use to fill that gap and any assumptions (about economy, donors, government, etc) you are relying on to make that strategy work.

Build ‘Predictability’ Confidence – Use A Monthly Cash Flow Budget

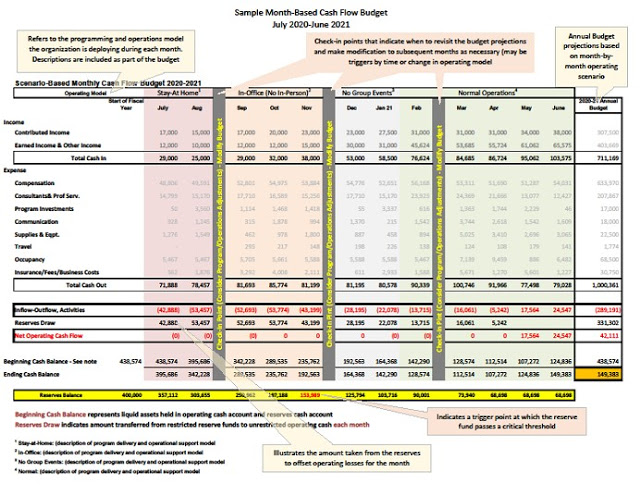

Using the scenarios you created about potential programming and operating models over the course of the fiscal year, create a monthly cash flow budget for each scenario.

This allows people to see when revenue and expenses are expected AND to see how the predicted revenue and expenses change each month based on the programming and operating model that you think may be in place at any given point of the fiscal year (see template below). It helps them know what to expect, what the operating assumptions are throughout the year, and what could change if external conditions shift one way or another.

*Any tool that aggregates data together needs to have supporting documentation with the details. For example, in the below budget, this version only has two aggregated revenue line items (Contributed Income & Earned Income). You would want to have another spreadsheet that actually broke out each of those categories in fine detail so you can track each and every revenue source and the assumptions associated with it. Click to download the sample budget.

Create Assumption Triggers

Throughout this process, you are building a new set of assumptions about what you will do under what conditions; the resources needed to do that; and the revenue you might be able to generate. Unlike the past, these assumptions are unvalidated. Therefore, you want to clearly identify the points at which you revisit and check assumptions and adjust your decisions and actions accordingly. Which conditions, when they present themselves, demand that you stop, pause, revisit, and readjust?

-

- What change in external conditions will affect your programming and operating model?

- What thresholds are you setting on reserve spending (both amounts and timing)?

- What revenue expectations/assumptions do you need to track (and with what regularity)?

- What levels of deficit/surplus will trigger conversations about revisiting your programming and operating capacity levels?

- What will you track to determine if the financial models for our operating scenarios are accurate (are expenses and revenues tracking with your predictions)?

Hold Yourself Accountable to a Strategy of Checking Assumptions – Not Trying to Land a Prediction

Remember that part, way back, about budgets being guesses. They are a predication of what we think the reality is likely to be over the next 12-18 months. This is currently unknowable in an innumerable set of ways.

By all means, we should be creating reasonable potential scenarios and playing out their predictions over the course of the next 12-18 months. That is a responsibility of governance…

However, we must not be bound by guesses we are making now, when the reality is likely to be different than imagined. Our greatest strength is to reassess based on where we actually are at any point in the future and what is knowable at that point in time.

Determine what your organization’s confidence window is – AND HONOR IT!

This may mean that 12 months is not a projection you can be confident or comfortable binding yourselves to. It may be that you need to check in every quarter, or every month, or when one of the above triggers is reached. And at that check-in point you may need to re-code your prediction – actually modifying your budget at its core and creating a new set of projections to work towards.

A 12-month confidence window is certainly not possible right now when it comes to actually managing cash flow (the thing that actually keeps doors open and salaries paid). Realistically, 12 weeks might be a stretch. Which means executive leadership may be focused on a rolling 12 week operating budget, tightly monitoring cash flow each week. (My guess is that every executive is doing this in some way already – because you all find amazing ways to make it work). This is your life line right now, not any projected 12 month budget.

Course changes are highly likely as our communities adjust to new social, economic, and political realities. We must be nimble in our ability to put down past assumptions and try out new ones. Even discarding the ones we are developing right now, if the future reality invalidates them. And, not holding our feet to the proverbial budget fire that was started with outdated assumptions (no matter how new or prescient we thought they were).

It’s All About Building Confidence

The budget process is a confidence game.

- We need confidence that we will be viable.

- We need confidence that we are serving the community.

- Our staff need to know we have confidence in their strategies and ability to adjust.

- We need confidence that we can reconsider our assumptions and chart a different path.

- We need to understand how much confidence our predictions warrant.

- We need to acknowledge where we lack confidence and comfort.

- And, we need to consider different process that build up our collective confidence in the organizations we serve.