In 2014, it was my honor to accept an appointment to the Internal Revenue Service’s Advisory Committee on Tax Exempt and Government Entities (the ACT). ACT members are appointed by the Secretary of the Treasury and advise the IRS on issues impacting tax exempt organizations and government entities. The ACT includes external stakeholders and representatives who deal with employee retirement plans; tax-exempt organizations; tax-exempt bonds; federal, state, local and Indian tribal governments. My colleagues on the ACT are exceptional individuals and I am humbled to be in their company. I serve on the Exempt Organizations subcommittee and, for the last year, have had the privilege of serving as a co-chair of the subcommittee. As part of my responsibilities, yesterday, I helped present our committee’s annual report to the Commissioner of the IRS, John Koskinen.

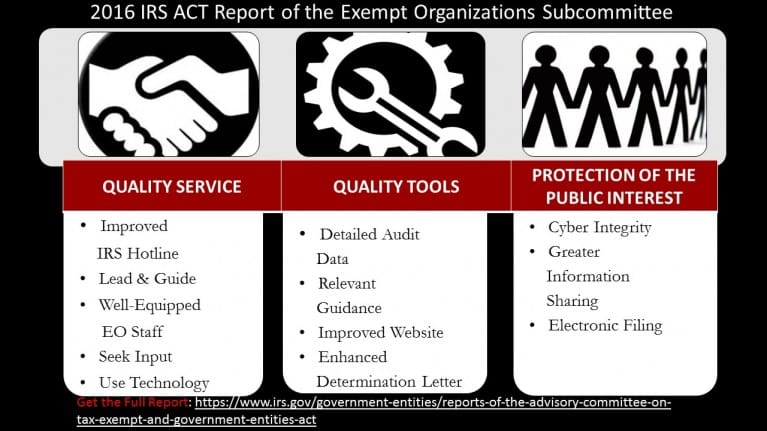

Today, it is my pleasure to share with you the 2016 report of the Exempt Organizations subcommittee of the IRS Advisory Committee on Tax Exempt and Governmental Entities. This year’s report to the Exempt Organization Leadership is titled Stewards of the Public Trust: Long-Range Planning for the Future of the IRS and the Exempt Community.

The report focuses on planning for the future – big picture areas the Exempt Organizations function should consider in planning for the next two to three decades in overseeing exempt organizations. The report makes recommendations to the IRS to prepare it for the challenges and environment in overseeing and regulating exempt organizations into the future. In connection with the report, the ACT conducted extensive interviews with exempt organization leaders, practitioners, and regulators to identify challenges and gaps for the IRS regarding its oversight of and guidance to the sector. We are grateful for the input received from the interviewees.

We encourage you to read the full report and to share it with the members of your networks.

The ACT was established under the Federal Advisory Committee Act to provide an organized public forum for discussion of relevant issues affecting the tax exempt and government entities communities.